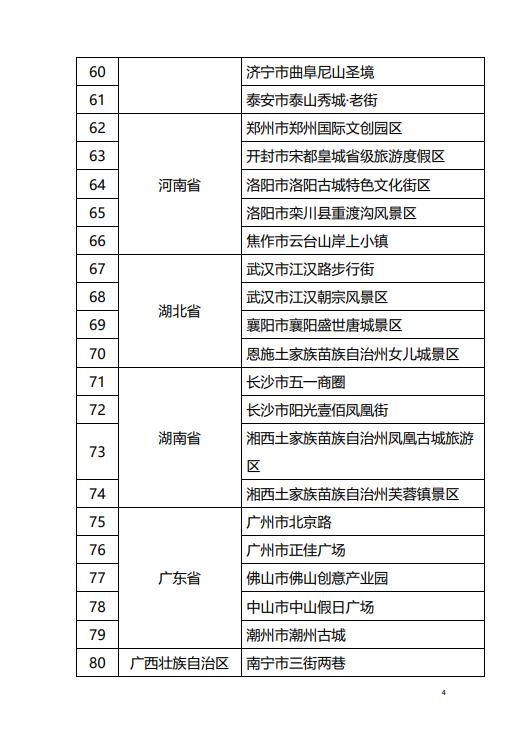

Shengyuan Environmental Protection has been investigated by 10 institutions: the company still has 8 put-into-production projects (garbage disposal scale of 5,950 tons/day and installed capacity of 16

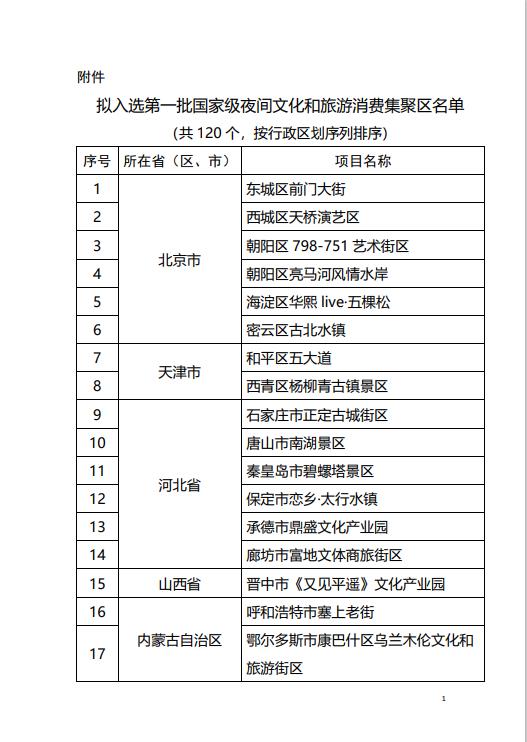

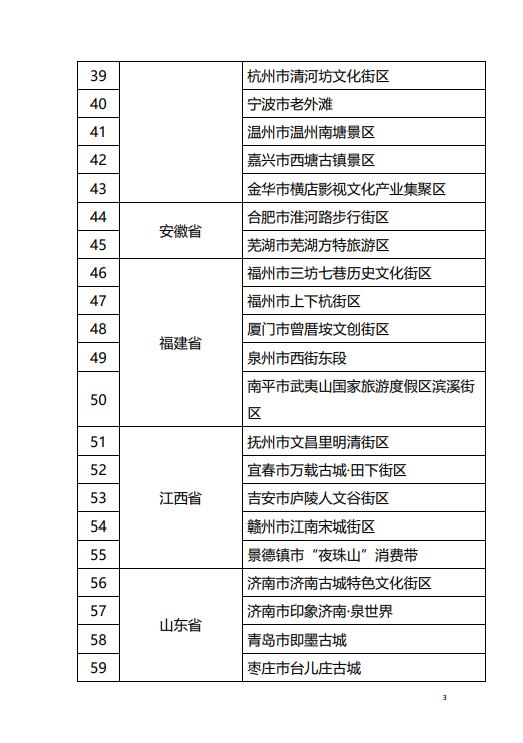

() The Record Form of Investor Relations Activities was released on September 26th. On September 26th, 2023, the company was investigated by 10 institutions, including other institutions, fund companies and securities companies. The main contents of investor relations activities are introduced:

Q: What are the main considerations and the overall marginal benefit scale of the new waste incineration power generation project?

A: The scale effect, return on investment, payback period and other financial indicators are mainly considered in the development of the new waste incineration power generation project, and the comprehensive factors such as the service population, service area, economic development level and local financial strength of the project location are used to make judgments and make prudent decisions. According to the company’s project operation and management level and experience, new projects generally need to reach the scale of 600 tons/day to reach the calculated break-even point and have certain economic benefits.

Q: Who are the main customers of the company’s more than one billion accounts receivable? What is the expectation of accounts receivable recovery?

A: The company’s main business is garbage incineration power generation and urban sewage treatment. The main sources of income are sewage and garbage treatment fees from local finance, electricity sales revenue from power companies and subsidies for electricity tariffs in countries connected to the Internet. Accounts receivable are mainly concentrated in the garbage, sewage treatment fees of local finance and the income from the state compensation for the on-grid electricity price. On September 20th, 2023, the State Council deliberated and passed the Special Action Plan for Clearing the Accounts Arrears of Enterprises, requiring the provincial government to take overall responsibility, and the central enterprises and state-owned enterprises to take the lead in paying back the debts, and strive to do everything possible and build a long-term mechanism. After the introduction of the plan, it will help to intensify efforts to solve the problem of government arrears in corporate accounts, and the company’s larger accounts receivable are expected to be alleviated as soon as possible.

Q: According to the periodic report disclosed by the company, the company’s business income includes a PPP project construction income. Please briefly explain it.

A: According to the Interpretation of Accounting Standards for Business Enterprises No.14 issued by the Ministry of Finance in January 2021, the company’s income composition increased the service income of PPP project construction. According to this standard, the company is the main responsible person of PPP project contract, and should confirm the income and cost related to construction services according to the income standard. Accordingly, the company adopts the cost additive process and confirms the construction service income according to the invested cost and the performance schedule. The gross profit margin of this business is low, which has little impact on the net profit. Under the current guiding principle that the company gives consideration to project income and cost and steadily expands new projects, with the projects under construction put into production one after another, the scale and proportion of this business income will gradually decrease.

Q: When can the company confirm the income of the new production projects that have not been listed in the national supplementary catalogue, and how much can it confirm?

A: Up to now, the company still has 8 projects that have been put into production (garbage disposal scale is 5,950 tons/day, and installed capacity is 160MW), which have not yet entered the list of national supplementary catalogues, and the corresponding income has not been confirmed yet. The above-mentioned projects all meet the main conditions and audit requirements of renewable energy power generation projects included in the subsidy list, and have been submitted for declaration as required. According to preliminary estimation, after all the above items are listed, the annual income of the state subsidy can be confirmed to increase by about 120 million yuan according to the normal income of the state subsidy. In view of the fact that the operating cost has been reflected in the financial statements in the early stage, the newly recognized income amount in the later stage is basically the pre-tax net profit amount. With regard to the time when newly put into production projects will be included in the national supplementary catalogue list, the company will fulfill its information disclosure obligations in a timely manner according to relevant rules, so please pay attention to the company’s relevant announcements at that time.

Q: It is reported that the Ministry of Ecology and Environment held an executive meeting on September 15, 2023, which reviewed and approved in principle the Measures for the Administration of Voluntary Emissions Reduction Trading of Greenhouse Gases (Trial), and demanded that the market system of voluntary emissions reduction trading should be improved promptly, and supporting management systems such as project design and implementation norms, project approval and verification rules, registration and trading rules should be released in time. What benefits does CCER restart bring to the company?

A: The company’s main business is domestic waste incineration power generation and domestic sewage treatment, which belongs to energy conservation and emission reduction and biomass power generation industry. It is an industry encouraged by the national carbon neutrality policy, and the resumption of the national unified CCER trading market will have a positive impact on the company. At present, the Measures for the Administration of Greenhouse Gas Voluntary Emission Reduction Trading (Trial) and related supporting management systems have not been officially promulgated, and the project methodology, project types and calculation methods have not been further clearly defined, so the company is temporarily unable to measure the company’s saleable carbon emissions. If we refer to CM-072-V01 "Multi-choice Waste Disposal Methods" (first edition, 2012) of China’s greenhouse gas voluntary emission reduction methodology, combined with the approved CCER project of waste incineration power generation, the accounting value of CCER output per ton of waste incineration is between 0.2 and 0.5 tons. The company is actively participating in the development of CCER, and the design scheme has been completed. At present, it is in the stage of filing and approval. After the release of the CCER filing management measures of the Ministry of Ecology and Environment, the company will continue to follow up.

Q: Without relying on expanding new projects, can the company’s main business performance of waste incineration power generation maintain steady growth? How about the application and popularization of medium temperature and sub-high pressure technology?

A: The company has been engaged in waste incineration power generation business for nearly 20 years, and has formed relatively stable project technical advantages, project construction experience and project management advantages. At the same time, it has continuously reduced the cost of technology, management and experience by promoting technological upgrading and refined management. At present, the application of the company’s medium temperature and sub-high pressure technology is mainly focused on the new production projects after 2021. Compared with other projects of the company, the power generation per ton of garbage with medium temperature and secondary high pressure technology has been obviously improved, from more than 300 degrees in the original medium temperature and medium pressure to more than 500 degrees, with an increase rate of about 60%, which varies from project to project. It usually takes at least three months to upgrade the old projects that have been put into operation, so it is necessary to comprehensively consider factors such as depreciation of original equipment and garbage disposal during shutdown. At present, the relevant preparations for technical transformation have been made, and it needs to be carried out step by step according to the actual situation of the project.

Q: Will membrane technology be used in the company’s business? Will the company make relevant layout for this membrane product and plan to enter the field of new materials?

Answer: The membrane technology used in the company’s waste incineration power generation business is generally used in the treatment of landfill leachate, and the specific membrane product is NF nanofiltration membrane. Landfill leachate generally goes through pretreatment +UASB anaerobic reactor +MBR biochemical treatment system +NF nanofiltration membrane +RO reverse osmosis process, and then is discharged into sewage plant for treatment or recycling. The company has no independent research and development and production for membrane products, and all of them are imported. The company has no business layout and investment plan in the field of new materials for the time being.

Q: What is the technical layout and application prospect of the company in the field of solid hydrogen storage?

A: The company’s solid-state hydrogen storage technology layout includes AB5 (rare earth system), AB (titanium system) and AB (iron-titanium system), and they are developed and prepared. The main products involved include hydrogen storage materials and hydrogen storage devices. Its application will be combined with the characteristics of solid hydrogen storage developed, and it tends to choose scenes with better economy and more possibility of commercialization, such as two-wheeled electric vehicles, forklifts, engineering vehicles, buses, public transportation, sanitation, tourism in sightseeing bus and other transportation fields, as well as centralized and distributed hydrogen storage power stations. Before the overall development of hydrogen energy industry accelerates or breaks out, the company will concentrate on technology research and development and actively prepare for the transformation and commercialization of knowledge achievements.

Q: Please briefly introduce the process route of hydrogen production from biomass, and what are the sources of raw materials for hydrogen production from garbage?

A: The company has both bio-fermentation hydrogen production and high-temperature pyrolysis and gasification hydrogen production on the technical route of biomass hydrogen production. Hydrogen production by biological fermentation is mainly based on the wet waste of the company’s kitchen waste project, and high-temperature pyrolysis gasification is mainly aimed at urban waste and industrial waste. The raw materials applicable to the biomass hydrogen production technology arranged by the company are mainly all kinds of solid waste, including but not limited to urban domestic waste, general industrial solid waste, kitchen waste, sludge from domestic sewage treatment, river sludge, waste forage, etc., and the raw materials are widely available.

Q: How can the company solve the problem of funds needed for the implementation of new business expansion?

A: Since the company went public, the cost of debt financing has dropped significantly, and the overall level of asset-liability ratio is in a downward trend. While optimizing the asset-liability structure, the company will reduce the financing cost and financial expenses by increasing the group credit line, innovating various financing channels and using idle funds. The company has established a good and stable cooperative relationship with local banks and other financial institutions, and the overall cost of capital is controllable. With the promotion of new projects, the company will consider raising funds through project loans, financial leasing and secondary market refinancing in the future;

Details of participating institutions are as follows: