Soda: the correlation between caustic soda and soda ash

The raw materials of caustic soda and soda ash are all salt, which belong to the salt chemical industry. The main production process of caustic soda is ion-exchange membrane electrolysis, brine refining, removing all kinds of impurities, making saturated brine, and producing 32% liquid caustic soda, chlorine and hydrogen through electrolysis. At present, this production process accounts for more than 99% in China. The production processes of soda ash include combined alkali process, ammonia-alkali process and natural alkali process. Ammonia-alkali and combined production use coal as fuel, use part of steam and electricity, and ammonia-alkali process consumes limestone. Natural alkali is mainly collected from natural alkali, and after a series of filtration and impurity removal, soda ash is prepared with low cost.

Soda and soda ash have their own differences. Caustic soda is commonly known as caustic soda, caustic soda, and the chemical formula is NaOH;; It belongs to Class 8.2 alkaline corrosive products in Grade 8 hazardous chemicals and belongs to strong alkali. There are two forms: solid caustic soda is white flake and granular crystal, liquid caustic soda is NaOH aqueous solution, and the mainstream specifications are 32% and 50%. The chemical formula of soda ash is Na2CO3, which is white and odorless powder or particles, easy to decompose at high temperature, strong electrolyte salts, soluble in water, alkaline in aqueous solution, corrosive and stable, but it can also be decomposed to generate sodium oxide and carbon dioxide at high temperature; Long-term exposure to air can absorb moisture and carbon dioxide in the air and generate sodium bicarbonate; Soda soda can react with acid, salt and alkali respectively, which belongs to salt rather than alkali.

However, there is a certain correlation between them. Both of them are raw salt in the upstream and used in alumina, printing and dyeing, paper making and other industries in the downstream, which belong to basic chemical raw materials. This paper mainly studies the correlation between caustic soda and soda ash.

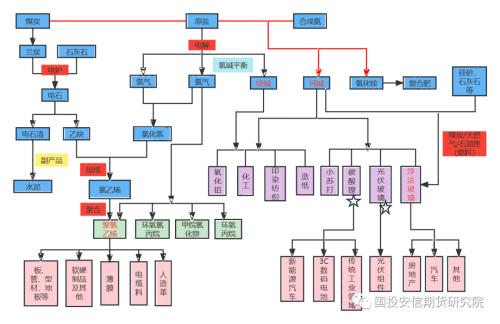

Figure 1: Salt Chemical Industry Chain

Source: Exchange, SDIC Anxin Futures.

1. The same upstream raw materials determine the high coincidence degree of their distribution areas.

The upstream raw materials of caustic soda and soda ash are raw salt. More than 90% of raw salt in China is used for soda ash and caustic soda, of which caustic soda consumption accounts for about 55.8% and soda ash accounts for about 38.2%. The added value of caustic soda and soda ash products is not high. When selecting the site, it is more concentrated in the distribution area of raw material capacity. By reducing transportation costs, the cost is reduced and the enterprise benefits are improved. Because both raw materials are raw salt, the capacity distribution of caustic soda and soda ash is highly coincident.

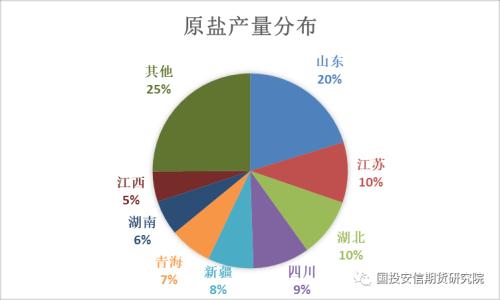

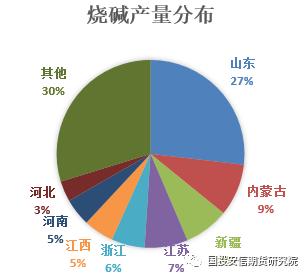

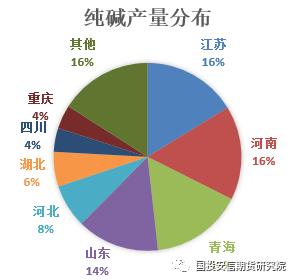

According to the provinces, the output of crude salt is mainly concentrated in Shandong, Jiangsu, Hubei, Sichuan, Xinjiang, Qinghai and other places, and the output of caustic soda and soda ash is also mainly concentrated in Shandong and Jiangsu, which is highly consistent with the distribution of crude salt production capacity. Among them, caustic soda is concentrated in Shandong, Inner Mongolia, Xinjiang, Jiangsu, Zhejiang and other places, and soda ash is concentrated in Jiangsu, Henan, Qinghai, Shandong, Hebei and Hubei. And some manufacturers produce soda ash and caustic soda at the same time, according to statistics, there are 5 in total, with a capacity of 3 million tons of soda ash and 250,000 tons of caustic soda; Tangshan Sanyou has a production capacity of 2.3 million tons of soda ash and 540,000 tons of caustic soda; Anhui Hongsifang has a production capacity of 350,000 tons of soda ash and 150,000 tons of caustic soda; Inner Mongolia Jilantai has a capacity of 350,000 tons of soda ash and 360,000 tons of caustic soda; Ningxia Risheng has a production capacity of 400,000 tons of soda ash and 140,000 tons of caustic soda.

Figure 2: Distribution of crude salt output by province

Source: National Bureau of Statistics, SDIC Anxin Futures.

Figure 3: Distribution of Soda and Soda by Province

Source: National Bureau of Statistics, SDIC Anxin Futures.

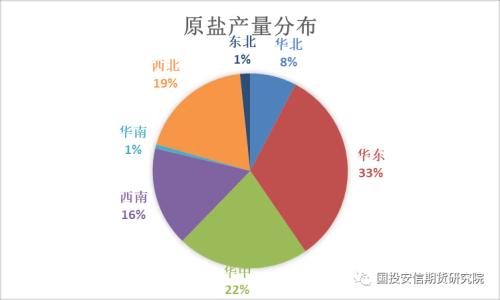

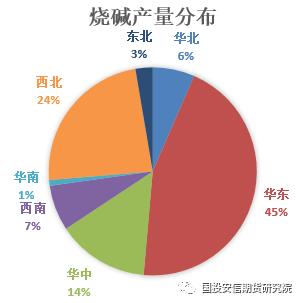

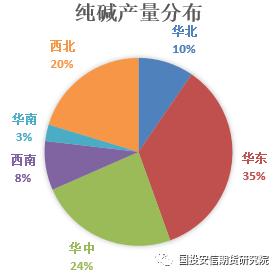

Regionally, the distribution of crude salt production is mainly concentrated in East China, Central China, Northwest China, Southwest China and North China, accounting for 33%, 22%, 19%, 16% and 8% respectively. The regional distribution of caustic soda and soda ash production is highly similar to that of raw salt, and it is also concentrated in the above areas, and the proportion of regional production is not much different.

Figure 4: Distribution of crude salt yield by region

Source: National Bureau of Statistics, SDIC Anxin Futures.

Figure 5: Distribution of caustic soda and soda ash by region

Source: National Bureau of Statistics, SDIC Anxin Futures.

2. Cost relevance

The production of one ton of caustic soda requires 2300-2400 degrees of electricity and 1.4-1.6 tons of raw salt, of which electricity accounts for about 60% of the production cost and raw salt accounts for about 20% of the production cost. However, the production process of soda ash and ammonia-alkali process are different, and the cost is different. Among them, ammonia-alkali process consumes about 0.5 tons of coal, about 170 degrees of electricity, about 1.5 tons of raw salt and about 0.04 tons of synthetic ammonia, in which raw salt accounts for about 20% of the production cost, power coal accounts for about 29% and electricity accounts for about 9%. 1.6-1.7 tons of coal, about 500 degrees of electricity, about 1.2 tons of raw salt and 0.345 tons of synthetic ammonia are consumed to produce a ton of soda ash by the combined alkali process, in which raw salt accounts for about 13% of the production cost, power coal accounts for about 17% and electricity accounts for about 10%. Both raw salt and electricity affect the cost of caustic soda and soda ash, and the influence of coal on electricity determines that the cost trend of caustic soda and soda ash is highly convergent. Judging from the historical price trend, in the first half of 2018 -2021, due to the small fluctuation of raw material prices, the cost of caustic soda fluctuated around 1,400 yuan/ton, the cost of ammonia-alkali method was slightly higher than that of caustic soda, the range of 1,400-1,600 yuan fluctuated within a narrow range, and the cost of combined soda fluctuated around 1,800 yuan. In the second half of 2021, the cost of both products rose sharply. Due to the greater influence of electricity on caustic soda, the cost of caustic soda fluctuated more than that of soda ash, and the cost climbed from 1,400 yuan to 2,600 yuan, an increase of 85.7%. The production cost of ammonia-alkali method increased from 1,600 yuan to 2,500 yuan.The increase rate reached 56.3%, and the double-ton cost of the combined alkali process increased from 1900 yuan to 2700 yuan, with an increase rate of 42%. After that, the cost of caustic soda and soda ash decreased with the attenuation of the limiting film.

Figure 6: Cost comparison of caustic soda and soda ash

Source: SDIC Anxin Futures

3. Price relevance

Because the same upstream and downstream also have overlap, the price correlation between caustic soda and soda ash is high, the correlation coefficient is 0.7, and the trend is basically the same. However, from the second half of 2020 to the first half of 2021, the price of soda ash soared, but the price of caustic soda fell slightly. Reasons for price split: the downstream of soda ash is mainly float glass and photovoltaic glass. In the second half of 2020 and the first half of 2021, the market of float glass and photovoltaic glass is good, and the production capacity continues to rise. Especially in recent years, driven by carbon neutrality, the production capacity of photovoltaic glass has increased greatly, and the downstream demand has increased. The output of soda ash can’t match, which is in short supply and the price has soared. During this period, the production capacity of alumina, the main downstream of caustic soda, fluctuated little, and the downstream demand increment was limited, but the output of caustic soda increased slightly, and the price was in a weak pattern.

Figure 7: The price correlation between caustic soda and soda ash is high.

Source: Zhuo Chuang Information, SDIC Anxin Futures.

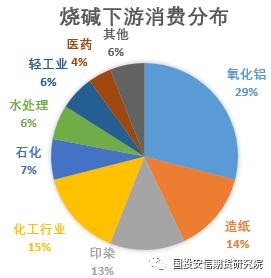

4. Downstream association

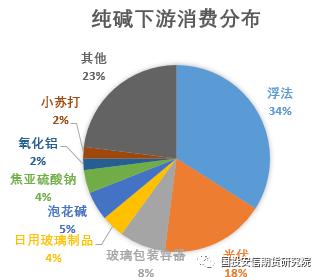

The largest downstream of caustic soda is alumina, which accounts for 29%, papermaking consumption accounts for 14% and printing and dyeing consumption accounts for 13%, while soda ash accounts for half of the consumption of heavy alkali and light alkali according to their different uses. Among them, heavy caustic soda is mainly used for float glass and photovoltaic glass, accounting for 34% and 18% respectively. The high prosperity of photovoltaic glass in recent years has made its consumption ratio increase continuously. In 2019, the output of photovoltaic glass was 6.14 million tons, and the consumption of soda ash reached 1.228 million tons. In 2022, the output of photovoltaic glass increased to 16.21 million tons, and the consumption of soda ash reached 3.242 million tons, which led to an increase of soda ash consumption by 164%. Light alkali is mainly used for daily glass, sodium silicate, sodium pyrosulfite, alumina, baking soda, etc. The substitution of caustic soda and soda ash is mainly in alumina, sodium silicate, monosodium glutamate, papermaking, printing and dyeing, washing and other industries. The choice of caustic soda or light alkali in these industries depends not only on the difference of process, but also on the price difference between them.

Figure 8: Downstream consumption of caustic soda and soda ash

Source: Zhengzhou Commodity Exchange and SDIC Anxin Futures.

5. How does the price difference affect the downstream alternative choice?

Generally, the price difference between 1.325* light alkali and 32% liquid alkali is used to see the price difference. From the historical trend of the price difference, most of the range is -1000- 500 yuan/ton. Before 2021, the price difference was mostly negative. After 2021, with the large-scale production of photovoltaics, the consumption of heavy caustic soda increased, and the price of heavy caustic soda rose rapidly, which made the price difference of light caustic soda higher than that of caustic soda, and the overall pattern of the industry changed to some extent. The price trend of light caustic soda was better than that of caustic soda. On the one hand, after soda ash went on the market, there would be some non-standard sets, which led to an increase in the demand for light caustic soda. In addition, the new energy concepts of photovoltaics and lithium carbonate were heavy. Recently, we have seen the price of caustic soda continue to fall, the inventory of soda ash is low, the price is firm, the price difference between light alkali and caustic soda continues to expand, and some downstream customers choose caustic soda to replace light alkali, which has dragged down the consumption of light alkali and caused the price to fall.

The price difference affects the downstream consumption choice. For alumina industry, his production processes mainly include sintering process, Bayer process and Bayer sintering combination. Bayer process uses caustic soda as raw material, and sintering process uses light alkali as raw material. At present, most alumina enterprises in China use Bayer process for production, mainly based on Bayer process’s simple process, short process and high product quality. However, the output of alumina produced by sintering process, series process and mixed process fluctuated in the range of 11 ~ 13%. Only some alumina plants in Shanxi and Chongqing maintain the production process in which the two methods coexist. Generally, when the price difference between them fluctuates little, it is not easy to replace the equipment, and only when the price difference is seriously unbalanced will the equipment be replaced. There are two production processes of sodium silicate: dry process and wet process. Soda is used in dry process and caustic soda is used in wet process. The traditional wet production process of sodium silicate is characterized by high energy consumption, high investment and complicated operation. The mainstream process in the market is dry process. Similarly, due to the consideration of equipment replacement cost, only when the price difference is seriously unbalanced will it be replaced. For washing and monosodium glutamate industries, there is no need to replace production equipment, so the alternative choice mainly considers the cost advantage and product quality difference brought about by the fluctuation of price difference between them. Among the alkali consumption in monosodium glutamate industry, the consumption of light alkali accounts for 75%, and that of caustic soda accounts for about 25%. The quality of products using light alkali is even better. Only the price of light alkali *1.325 far exceeds the price of liquid alkali. Enterprises choose caustic soda to replace light alkali, which reduces production costs.

Figure 9: Trend chart of the price difference between them.

Source: Zhuo Chuang Information, SDIC Anxin Futures.

6. Summary

Caustic soda and soda ash have a certain correlation. The same raw materials in the upstream determine the high overlap of their capacity distribution areas and the high synergy of their cost trends. In addition, the overlap in the downstream industries such as alumina, sodium silicate, paper making, printing and dyeing, monosodium glutamate and so on determines the high correlation of their price trends. The price difference between caustic soda and soda ash will affect the downstream alternative consumption choice.