() The operating comments of the Board of Directors in 2023 are as follows:

I. The industry in which the company is located during the reporting period.

(1) The main business and products the company is engaged in.

During the reporting period, around the company’s "14th Five-Year Plan" industrial development plan, the company closely followed the market demand, adhered to the basic idea of "focusing on the main business, expanding the main business and strengthening the main business", and continued to devote itself to the production and sales of soda ash, baking soda and urea made from coal by natural alkali. Among them, soda ash and baking soda made from natural alkali are the leading products of the company, and their production and sales are in the forefront of the industry. In 2023, the company produced 5.68 million tons of various products, including 2.69 million tons of soda ash, 1.18 million tons of baking soda, 1.67 million tons of urea and 140,000 tons of other chemical products.

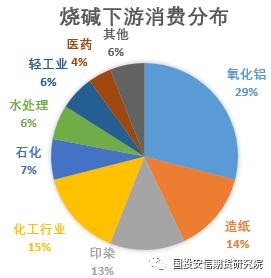

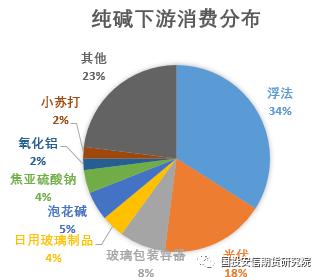

The downstream of soda ash is mainly concentrated in glass, metallurgy, paper making, printing and dyeing, synthetic detergent, food and medicine and other industries; Baking soda is mainly used in food, feed, medicine and health industries; Urea is mainly used for the growth of various soils and crops, which can promote crop yield.

During the reporting period, the company faced many unfavorable factors, such as the year-on-year decline in product market price, the year-on-year decline in gross profit of stock enterprises, and the year-on-year decrease in investment income of major shareholding companies. On the one hand, the company ensured the continuous and efficient operation of major production devices through continuous strengthening of operation management, on the other hand, it promoted the construction of the first-phase production line of Alashan Tartar Lignin trona Project in Yingen Mining in an orderly manner. During the reporting period, some production lines of the first phase of Alashan Tower Lignin Natural Alkali Project of Yingen Mining were put into production, and the production capacity was gradually released, which to some extent offset the adverse effects caused by the decline in product prices.

According to the standard unqualified audit report issued by Dahua Certified Public Accountants (special general partnership), during the reporting period, the company realized operating income of 12.044 billion yuan, net profit attributable to the parent company of 1.410 billion yuan, net profit not attributable to the parent company of 2.414 billion yuan, weighted average return on equity of 10.88% and earnings per share of 0.39 yuan. At the end of the reporting period, the company’s total assets were 34.094 billion yuan, owners’ equity was 17.931 billion yuan, owners’ equity was 13.486 billion yuan, and net assets per share was 361 yuan.

(II) Development of the industry in which the company is located

1. Soda industry

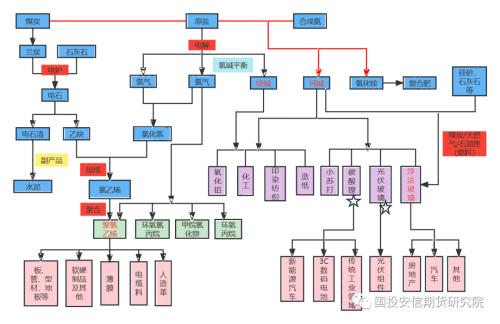

The components of soda ash are sodium carbonate (Na2CO3), commonly known as soda and washing alkali. Soda soda can be divided into industrial soda and food additive soda according to different uses. China is a big producer and consumer of soda ash. At present, the domestic production capacity accounts for about 46% of the world production capacity. Industrial soda ash can be divided into light soda ash and heavy soda ash based on different densities. Soda soda is mainly used in glass, metallurgy, paper making, printing and dyeing, synthetic detergent, food and medicine, etc. Among them, the glass industry is the main consumption department of soda soda soda, and the consumption of soda soda soda per ton of glass is about 0.2 tons, accounting for nearly 60%. In addition to the traditional industry demand, under the background of "double carbon", the soda ash industrial chain has entered a new stage of development, and the demand for new energy such as photovoltaic and lithium battery will take over from flat glass, contributing to the main increase of soda ash demand in the future.

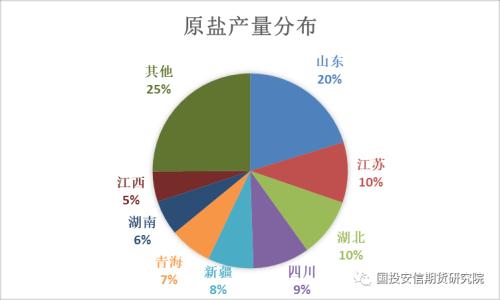

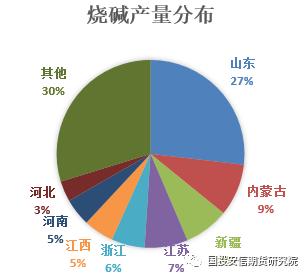

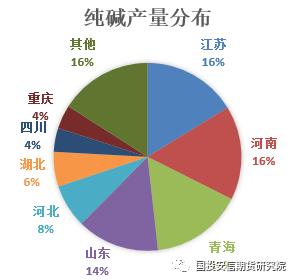

In 2023, the supply and demand of domestic soda ash industry are basically balanced. Although the new capacity base of the supply side is large, the output is put into the third and fourth quarters, and the annual increment is limited. On the demand side, the float glass industry, the largest consumer sector, is affected by public construction projects and the policy of ensuring the delivery of buildings, with improved demand and increased production capacity. The consumption of soda ash by photovoltaic glass and lithium carbonate continues to grow, and in 2023, it will become the largest consumer industry in the proportion of downstream demand structure of soda ash. According to the statistics of China Soda Industry Association, by the end of 2023, the national soda production capacity reached 35.33 million tons, and the output reached 32.28 million tons, up 10.9% year-on-year. Among them, the combined alkali method, ammonia alkali method and natural alkali method accounted for 48.5%, 43% and 8.5% respectively. The annual apparent consumption of soda ash was 31.585 million tons, up 11.8% year-on-year.

Driven by the "double carbon" policy background and market demand, the photovoltaic industry has a broad long-term growth space, and has become a strategic new industry that has reached the international leading level in China and an important engine to promote China’s energy reform.

In 2024, it is expected that the demand for soda ash will continue to grow, with the main growth point in the new energy industry. Under the background of global energy transformation, the production capacity of photovoltaic glass and lithium carbonate continues to expand, driving the growth of soda consumption. The production capacity of float glass industry is at a high level at present. In 2024, it is planned to resume production and focus on new ignition production lines. It is expected that the consumption demand for soda ash will increase slightly year-on-year.

2. Urea industry

In 2023, the domestic urea market generally showed an industry pattern of increasing supply and demand. In the first half of the year, under the fundamental influence of raw material prices and mismatch between supply and demand, the urea market fluctuated downwards. In the second half of the year, with the promotion of economic recovery process, the centralized release of agricultural demand and export demand, the urea market price rebounded and continued to fluctuate. Throughout 2023, the supply and demand of China’s urea market are generally in balance. According to the data of China Nitrogen Fertilizer Industry Association, in 2023, the national urea industry capacity was about 68.23 million tons, up 4.0% year-on-year, and the annual urea output was 62.92 million tons, up 9.2% year-on-year. Apparent consumption of urea was 58.667 million tons, up 7.1% year-on-year.

In 2024, the domestic urea supply situation is expected to be loose and the production capacity is expected to increase. On the demand side, in 2024, the grain production target of Document No.1 of the Central Committee was locked at more than 1.3 trillion Jin for the fourth time in a row, and the overall goal of grain production is still to increase and stabilize production, so the agricultural demand for urea is expected to remain stable. In terms of industrial demand, the consumption of downstream compound fertilizer, melamine, power plant desulfurization and other industries is expected to increase significantly. The China Nitrogen Fertilizer Industry Association predicts that the demand for urea industry will reach 21.5 million tons, an increase of about 2 million tons year-on-year.

3. The impact of new regulations and industry policies

On July 12th, 2021, Alxa League Water Affairs Bureau of Inner Mongolia issued the Decision on Approving the Administrative License for the Development and Utilization of Lignin Natural Alkali (8.6 million tons/year) in Alxa Pagoda in Inner Mongolia and the Special Water Supply Project for the Yellow River (A Shui Permission Zhunzi [2021] No.46), agreeing that the Alxa Pagoda Natural Alkali Project and the Special Water Supply Project for the Yellow River should use the surface water from the main stream of the Yellow River as the water source, and the total annual water consumption of the approved projects is 21.824 million. In view of the fact that Yingen Water, a wholly-owned subsidiary of Yingen Mining, obtained the Yellow River water intake index of 3.5 million cubic meters/year at that time, and the water administrative license decided to allow the water intake of 3.5 million cubic meters/year, it will apply for changing the water intake permit procedures in time after obtaining the water indicators.

Article 50 of the Law on the Protection of the Yellow River, which was implemented on April 1, 2023, stipulates that the water intake permit for the main stream of the Yellow River must be obtained from the basin agencies. At the end of the reporting period, the local water administrative department has handed over the examination and approval procedures and related materials to the Yellow River Conservancy Commission, which has accepted and started the examination and approval procedures, and the company is currently docking and promoting related work as required.

(III) The position of the company in the industry

The company is one of the oldest soda production enterprises in China. It has been deeply involved in the natural soda industry for many years and has a certain brand awareness. With the commissioning of the first phase of Alashan natural soda project, during the reporting period, the company’s soda production capacity was 5.8 million tons/year, baking soda production capacity was 1.5 million tons/year, urea production capacity was 1.54 million tons/year, and soda and baking soda production capacity ranked among the top in China.

The Alashan natural soda project of the company plans to build 7.8 million tons of soda ash and 800,000 tons of baking soda, of which 5 million tons of soda ash and 400,000 tons of baking soda are planned in the first phase, and 2.8 million tons of soda ash and 400,000 tons of baking soda are planned in the second phase. The first phase of the project was put into trial operation in June 2023. As of the disclosure date of this report, the first, second and third production lines have been put into production, and the fourth production line is in trial operation. The second phase of the project started construction in December 2023.

(IV) The technological process of the company’s main products

(V) The main business model of the company

1. Production mode

All the companies and enterprises are continuous production enterprises, adopting the stocking production mode, and the production mode is the device production mode. According to the capacity and market situation of the device, the product structure and production scale in the cycle are determined, and on this basis, the annual production operation plan is formulated, and the raw materials are prepared and purchased to organize production. The production efficiency and quality of an enterprise mainly depend on the continuity of raw materials and equipment and the capacity of the equipment.

2. Purchasing mode

The company follows the requirements of internal control guidelines of listed companies, combines the practical experience of the company for many years and the characteristics of the industry in which it is located, establishes a material procurement management Committee, integrates project bidding and production and operation procurement management, and strengthens collaborative procurement with suppliers through the implementation of electronic systems to achieve centralized procurement management.

3. Sales model

The company’s main products are uniformly sold by subsidiaries, and a marketing system with large customers as the core and combining direct sales, distribution and online sales is established.

(VI) The Company’s mineral resources

By the end of 2023, the company had two natural alkali mines, Anpeng and Wucheng, in Tongbai County, Henan Province, and Chagannuoer alkali mine and Tamulin natural alkali mine in Inner Mongolia, of which Anpeng alkali mine had proven reserves of 193.08 million tons and retained reserves of 123.67 million tons. Wucheng alkali mine has proven reserves of 32.67 million tons and retained reserves of 19.28 million tons; Chagannuoer alkali mine has accumulated proven reserves of 11.34 million tons and retained reserves of 1.8208 million tons; The ore reserves and recoverable reserves of Alashanta lignin trona mine are 1,078,364,000 tons and 296,900,100 tons respectively. The company holds 34% equity of Mengda Mining, and the coal reserves and recoverable reserves of Nalinhe No.2 Mine of Mengda Mining are 1.157 billion tons and 711 million tons respectively.

II. Main businesses of the Company during the reporting period

The company’s chemical fertilizer products are mainly urea and liquid ammonia. The company’s holding subsidiaries Boda Field and Xing ‘an Chemical are coal chemical enterprises based on the advantages of coal resources and supported by technological innovation. The main products are urea, compound fertilizer and synthetic ammonia.

The company’s fertilizer products are mainly sold through the company’s wholly-owned subsidiaries and distributed by dealers at all levels. Boda Field and Xing ‘an Chemical are located in the hinterland of Ordos and Xing ‘an League respectively, which have good market advantages, logistics advantages and customer resources advantages, ensuring the steady growth of the company’s product sales. The company’s "Broad Field" and "Boyuan Rich Farmers" brands have accumulated high popularity and brand reputation in the urea industry, which has been widely recognized by customers.

In 2023, the export scale of the company’s fertilizer products was small, and the tax policy of the company’s fertilizer products did not change.

Engaged in chlor-alkali and soda industry

The industrial chain layout of the company is mainly soda ash and baking soda, and the existing devices can realize the output adjustment and cooperation of soda ash and baking soda.

In 2023, the company’s energy consumption per unit output value was 1.69 tons of standard coal/10,000 yuan. Because the Alashan natural alkali project of the company is in the trial production stage, considering the stability of the production system and the accuracy of the measurement system, it is not possible to accurately and quantitatively analyze the energy consumption of the project equipment, so the product energy consumption in the trial production stage is not included in the energy consumption statistics; At present, the soda industry has not formulated standardized requirements for the energy consumption of soda production value by natural soda production.

Zhongyuan Chemical, a subsidiary of the company, needs electricity for production, conducts multilateral trading of electricity through a third-party power trading platform, and does not enjoy preferential policies related to electricity prices. The fluctuation of electricity prices has a more obvious impact on manufacturing costs.

Most of the TV universities needed for the production of Alashan trona project are self-generated, and a few of them conduct multilateral trading of electricity through third-party power trading platforms and enjoy preferential policies related to electricity prices. The fluctuation of electricity prices has no obvious impact on manufacturing costs.

Third, the core competitiveness analysis

(A) rich in resource reserves

The company has two natural alkali mines in Tongbai County, Henan Province, Anpeng and Wucheng, and Chagannuoer alkali mine and Tamulin natural alkali mine in Inner Mongolia, of which Anpeng alkali mine has proven reserves of 193.08 million tons and retained reserves of 123.67 million tons; Wucheng alkali mine has proven reserves of 32.67 million tons and retained reserves of 19.28 million tons; Chagannuoer alkali mine has accumulated proven reserves of 11.34 million tons and retained reserves of 1.8208 million tons; Alashanta lignin trona mine has a reserve of 1,078,364,000 tons and recoverable reserves of 296,900,100 tons respectively, which is the largest trona mine in China and provides a solid guarantee for the company’s long-term development.

(B) Industrial capacity advantages

The company has been deeply involved in the natural alkali industry for many years, and has always focused on the research and development of natural alkali resource exploitation and processing technology. It has a national enterprise technology center and Inner Mongolia natural alkali engineering center, which is at the leading level in the field of natural alkali chemical industry in China and has independent intellectual property rights. Now it has mature comprehensive industrial capabilities such as natural alkali research, development and management.

(C) the advantages of environmental protection

The company adopts the domestic advanced hydrothermal solution mining process to extract trona from underground, and makes soda ash products by pure physical evaporation process. After production, the tail liquid continues to be recycled for trona ore solution mining, and there is no waste liquid discharge in the whole process. The produced soda ash and baking soda products have the advantages of environmental protection.

(D) Marketing advantages

During the reporting period, the company separated production from sales, closely linked all links, paid close attention to and grasped industry policies and market changes, and seized the market initiative. The sales team strengthened communication with downstream manufacturers and grasped the production and operation trends of downstream manufacturers in real time. Through the separation of production and marketing and precise marketing, we will deepen the downstream market and provide a strong guarantee for the company to improve quality and efficiency and achieve full production and sales.

Fourth, the main business analysis

1. Overview

During the reporting period, faced with the complicated and severe domestic and international market situation and many risk challenges, the company focused on the annual task objectives, paid close attention to business management, continuously optimized the management system, comprehensively promoted the construction of digital intelligence, made great efforts to promote project construction, and successfully completed various task objectives. The company achieved an annual operating income of 12.044 billion yuan, an increase of 9.62% over the previous year. The net profit attributable to shareholders of listed companies was 1.410 billion yuan, a decrease of 46.99% over the previous year. The net profit attributable to shareholders of listed companies after deducting non-recurring gains and losses was 2.414 billion yuan, a decrease of 9.40% over the previous year. Over the past year, the main work is as follows:

(1) Strengthen the basic defense lines of safety production and environmental protection. The company’s safety and environmental protection were "steady and orderly", and no major or above production safety accidents and environmental accidents occurred throughout the year, achieving the goals of "four zeros" in safety production and all environmental protection pollutants reaching the standard. The production and operation of all enterprises are stable and orderly as a whole, and the first phase products of Alashanta lignin natural alkali project of Yingen Mining are put on the market.

(2) The project construction progressed steadily. The company steadily promoted the construction of Alashanta lignin trona project in Yingen Mining. The first phase of the project was mechanically completed in 2023, and the second phase was started at the end of 2023. According to the construction plan, the preliminary work such as engineering design, site exploration, part of long-term equipment orders and project commencement procedures were carried out.

(3) Strengthen the assessment, improve the system, and gradually improve the standardization and efficiency of management. In 2023, the company systematically sorted out and evaluated 97 systems in the internal control system, and completed 38 new, revised and abolished systems, which further improved the system construction and further improved the overall standardized operation and management level of the company.

(4) Continuously improve the ability of information technology, digital transformation and intelligent application. The company’s BIP system was put into operation in 2023, which completed the switch between old and new systems, initially realized the integrated operation of procurement, sales, manpower and finance, and improved the operational efficiency and management level. Bocai Tesco platform and file management system were successfully put into operation. The construction of Boda Field and Xing ‘an Chemical Intelligent Double Preventive Safety Control Platform was completed, and the core production processes of Zhongyuan Chemical were orderly incorporated into the intelligent dispatching platform. The company’s overall essential safety level and production efficiency have been significantly improved.

(5) Strengthen incentives and optimize teams. In 2023, the company implemented restricted stock incentives, which basically covered key managers and core technicians at the grassroots level, and the number of motivators reached 229. The implementation of equity incentive has effectively stabilized the management team of the enterprise, stimulated the enthusiasm and motivation of key managers and core technicians, and further activated and tapped the positive internal drive of the enterprise itself. At the same time, the company pays attention to improving management efficiency, and systematically improves the management skills of middle-level managers through professional standardization, online micro-courses and special training. In addition, the company also carried out two training programs for reserve talents and the assessment of employees’ professional quality, which laid a solid foundation for the refinement of human resource management.

(6) Party building leads high-quality development. The company earnestly organizes and carries out the education on the theme of studying and implementing Socialism with Chinese characteristics Thought of the Supreme Leader in the new era, comprehensively implements the spirit of the 20th Party Congress, completely, accurately and comprehensively implements the new development concept, continuously promotes the integration of Party building and production and operation as the main line, continuously promotes the deep integration of Party building and production and operation, and leads high-quality development with high-quality Party building.

V. Prospect of the Company’s Future Development

(I) the company’s future development plan

2024 is a crucial year for the company to seize new opportunities, meet new challenges and achieve new development. The company will adhere to the complete, accurate and comprehensive implementation of the new development concept, actively integrate into the new development pattern, adhere to the general tone of steady progress, coordinate production and operation and key project construction, maintain strategic strength, strengthen development confidence, lay a solid management foundation, further improve business performance, and strive to create a new situation of high-quality development of the company. In order to achieve the company’s strategic objectives and business plan, the company intends to focus on the following work.

1. Insist on relying on resources, market-oriented, supported by science and technology, taking honesty and trustworthiness as the fundamental criterion, and promote the establishment of enterprises by industry, the development of enterprises by science and technology, the strengthening of enterprises by talents, and the cultural and plastic enterprises, focusing on cohesion and concentration, and making the two main businesses of refined natural alkali and nitrogen fertilizer bigger and stronger. Taking the road of intensive, green and high-quality development, trona will change from an industry follower to an industry leader, and strive to develop into a leading enterprise in soda ash industry during the 14 th Five-Year Plan period.

2. The trona industry, while expanding its production capacity and increasing its market share, further enhances its product quality and brand influence, inclines to improve its product quality through technological transformation and innovation, comprehensively improves its product quality, and strengthens market situation judgment and market segmentation. At the same time, with the goal of extending the industrial value-added chain and value chain, we will focus on the differentiation of product categories, functions and value-added services in the field of daily baking soda FMCG, improve the added value of products and expand the company’s new profit growth points.

3. Based on the existing equipment and production capacity, the nitrogen fertilizer industry should take the road of "specialization and innovation" and "little giant" enterprise development, take "green agriculture" as the core strategy, increase varieties, improve quality, create brands, benchmark advanced, catch up with advanced, increase the proportion of high-end chemical products, and extend to high-quality and high-end value chain.

4. During the "Tenth Five-Year Plan" period, in response to the national "double carbon" strategy, both the natural alkali industry and the nitrogen fertilizer industry should dig deep into the transformation potential of energy-saving and carbon-reducing technologies, benchmark the advanced energy efficiency level of domestic and foreign production enterprises, accelerate the storage, promotion and application of advanced and mature green low-carbon technologies, explore the green low-carbon development route of coupling green hydrogen, green ammonia and green methanol through the "new energy+"model, and realize industrial upgrading and transformation.

(2) Possible risks

1. Industry risks

Affected by factors such as industry policies, economic operation cycle and industry capacity release, the company may face the risk of rising operating costs and product price fluctuations.

The company will continue to strengthen the research on the macroeconomic situation, pay close attention to the trend of national policies, coordinate the domestic and international markets, optimize marketing strategies and market layout, provide impetus for the company’s current and future development, and promote the company’s sustained and high-quality development.

2. Safety production risks

The process flow of chemical enterprises is complex, and there are certain safety risks in the process of production and transportation. Although the company has established a relatively complete safety production management system, accident early warning and handling mechanism and safety education and training system, and paid attention to continuous improvement in combination with the actual situation, it does not rule out the possibility of accidents caused by improper operation, equipment failure and changes in natural conditions, which will affect the normal production and operation of the company.

The company will keep the bottom line of safety and environmental protection, continue to eliminate potential risks of safety and environmental protection and compliance with laws and regulations, continue to lay a solid foundation for safety development, improve the level of intrinsic safety, continue to promote the construction of dual prevention systems, build a long-term mechanism for safety production, continuously strengthen the safety awareness and responsibility awareness of all employees, create safer and more stable production and operation conditions, and organize production according to laws and regulations.